Advertisement

In Franklin County, there have been 56,714 evictions filed since 2020. In 2022 there were 2,311 foreclosure-related filings. More and more residents are unhoused. The Auditors property reappraisals and property taxes are coming due and their numbers are soaring.

Columbus Mayor Andrew Ginther has given out well over $600 million in tax abatements since he became mayor. Hundreds of millions of dollars in revenue that should have gone to Columbus City Schools went into the bank accounts of corporate Columbus, developers, and others. And the burden to make up for those who don’t pay their fair share of property taxes has been placed on those who can least afford to for too long.

Ginther’s policy of giving out tax abatements in return for campaign contributions has been escalating our affordable crisis for years. It is forcing low-moderate income homeowners and seniors out of their homes. Landlords who once provided truly affordable housing are raising rents where tax abated new developments are being constructed in gentrifying neighborhoods. This forces more and more people to move and find affordable housing that doesn’t exist.

I have always been and will continue to be a strong supporter of public education, unlike Andy Ginther. My two grown children benefitted from 12 years of attending Columbus City Schools. I have marched a half a dozen times with members of CEA union while fighting to improve our schools and educational opportunities for our youth.

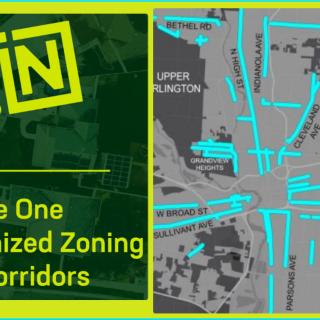

But as long as Ginther continues to hand out unnecessary tax abatements to major corporations and luxury real estate developers in the Short North, Downtown, Scioto Peninsula, Franklinton, and North Market and Arena Districts, I will not support a levy that costs homeowners $269.50 per $100,000 of appraised value.

As mayor of Columbus, dirty campaign contributions from developers and other special interests will not exchange hands with me in return for tax abatements and other corrupt city contract steering.