It’s bad enough that the Mayor and Columbus City Council hand out tax abatements as though every Monday is Halloween. Central Ohio leads the state in granting tax breaks to the tune of $5.82 billion. Tax abatements for wealthy developers and corporations are contributing to reduced revenue for our public schools, social services, and burdening homeowners with unattainable higher property taxes.

Ohio Revised Code 5709.82 requires the city of Columbus to “pay affected school districts 50 percent (50 percent) of the municipal income tax revenue attributable to tax abated projects where the annual ‘new employee’ payroll for a project is one million dollars for an Enterprise Zone (EZ) or for a Community Reinvestment Area (CRA) two million dollars or more, in a given tax year, during the abatement.”

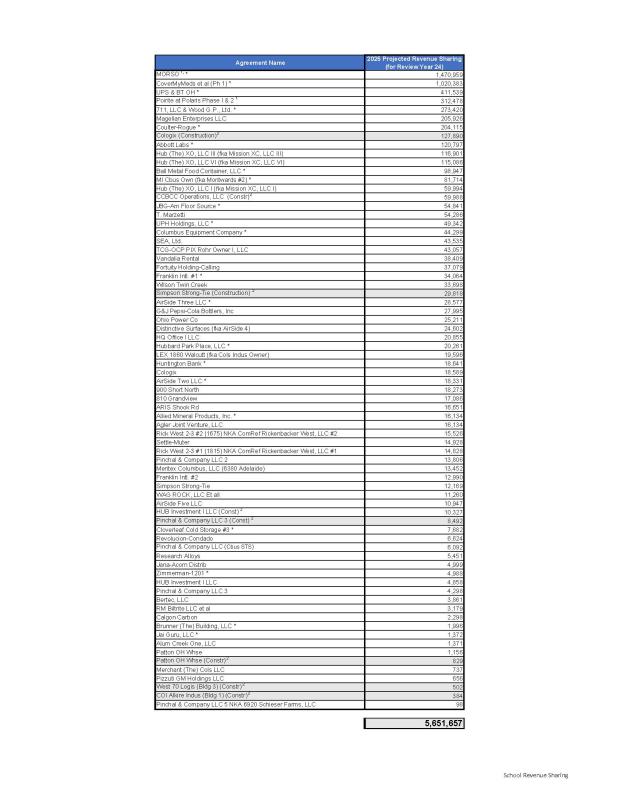

Columbus City Council passed Ordinance 1963-2025 (see attached agenda) this evening paying $5.7 million out of our General Fund to subsidize 55 tax abated projects that are required to make revenue payments to seven local school districts. Money that should be earmarked to address our homeless and affordable housing crisis, new sidewalks, upgrading crosswalks, new playground equipment and new swimming pools, paving alleys. You name it.

At the top of the list of the 55 corporations and developers (see attachment), we are subsidizing MORSO (Easton) $1.4 million who received a $68 million tax abatement. CoverMyMeds $1 million for their $77.7 million tax abatement. UPS $411,000 for their $10.4 million handout. And Google $206,000 for their $54 million pork chop. You mean to tell me they can’t afford to pay this themselves and we can’t figure out a way around this law to make them pay it?

In 2023 alone, CRA and Enterprise Zone tax abatements were responsible for the loss of $76.7 million in property tax revenue. That’s excluding TIF’s. About $29 million in public school revenue lost. Children Services lost $14.5 million. In 2021 Columbus City Schools lost $51 million in revenue. $48 million in 2020. $42 million in 2019.

We the people are getting property taxed to death. These tax abatements are stripping millions of dollars in revenue away from public education and social services at a time when such revenues are being slashed by our state and federal governments.

It’s long overdue that the Mayor and City Council put an end to placing the burden of higher property taxes on the poor, middle and working-class citizens of our communities. And in the meantime, maybe the mayor can find time in between his self-serving world travels and put our city attorneys to work to find a way around this ridiculous revenue sharing state legislation that removes funding from our general fund which further subsidizes wealthy developers and corporations.